Table of Contents

- The IBM Stock Is Not Microsoft And It Is Thus Not Poised To Explode In ...

- No, It Isn’t Time To Sell IBM Stock | MarketBeat

- IBM's Stock Rises 7% On Strong Earnings Report | MENAFN.COM

- IBM Stock Analysis - Is IBM Stock Worth Buying Today? - YouTube

- IBM's stock takes a hit after mediocre earnings report | Fortune

- IBM stock jumps to 10-year high on accelerated AI growth

- Why You Should Think of IBM Stock as a Blockchain Stock | InvestorPlace

- IBM Stock Has Pros and Cons, But Is It a Buy? | Markets Insider

- IBM share price opens down following historic Red Hat acquisition - Verdict

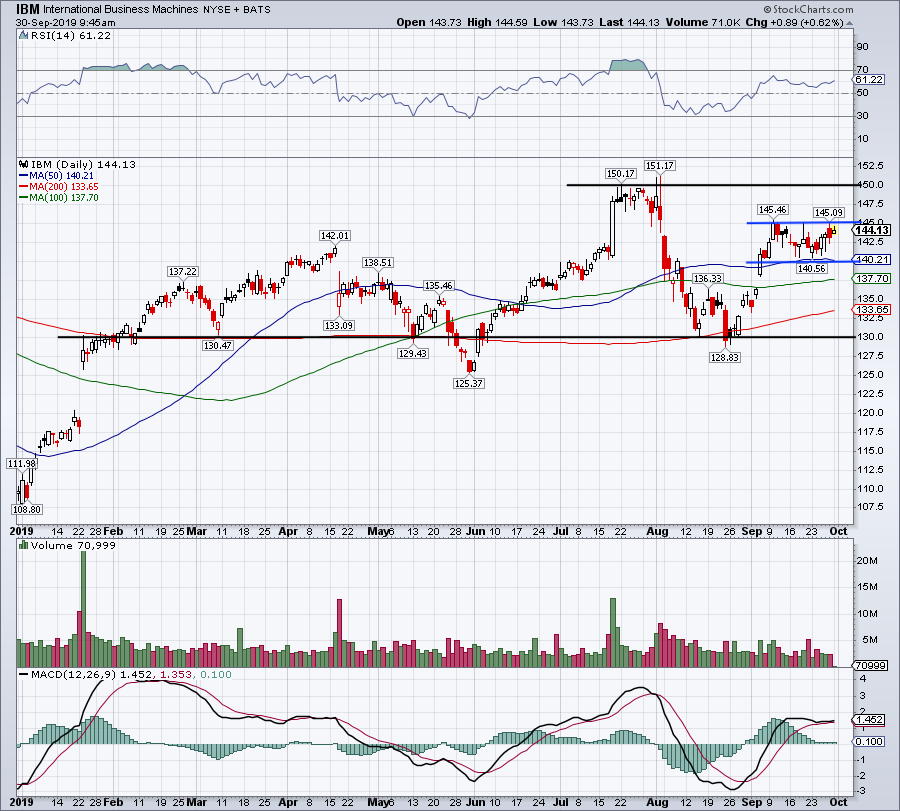

- Stocks to Watch $IBM (International Business Machines)

A Brief History of IBM

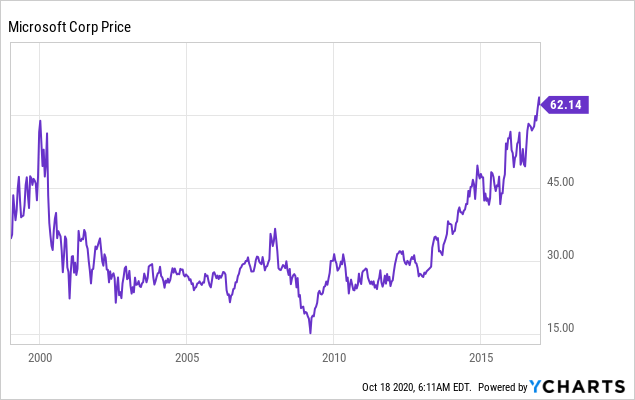

IBM Stock Price Overview

Financial Performance

IBM's financial performance has been steady in recent years, with the company reporting revenue of $77.1 billion in 2020. The company's net income for 2020 was $11.4 billion, with a gross margin of 46.3%. IBM's cloud business has been a significant contributor to its revenue growth, with the company reporting a 19% increase in cloud revenue in 2020.

Dividend Yield

IBM is known for its attractive dividend yield, which currently stands at around 4.7%. The company has a long history of paying consistent dividends, making it a popular choice among income-seeking investors. IBM's dividend payout ratio is approximately 50%, indicating that the company has a stable and sustainable dividend policy.

Growth Prospects

IBM's growth prospects are promising, driven by its strategic investments in emerging technologies such as artificial intelligence, blockchain, and quantum computing. The company's cloud business is expected to continue growing, driven by increasing demand for cloud infrastructure and services. Additionally, IBM's strategic partnerships with leading companies such as Apple, Google, and Microsoft are expected to drive growth in the coming years. In conclusion, IBM is a technology giant with a rich history and a strong market presence. The company's stock price has been steady in recent years, driven by its stable financial performance and attractive dividend yield. With a promising growth outlook driven by emerging technologies, IBM is an attractive investment opportunity for investors looking for a stable and sustainable return on investment. Whether you're a seasoned investor or just starting out, IBM is definitely worth considering as a potential addition to your investment portfolio.Disclaimer: The information contained in this article is for general information purposes only and should not be considered as investment advice. It is always recommended to consult with a financial advisor before making any investment decisions.